Introduction

In 2025, finance apps use AI insights, smart automation, and real-time data to help users manage money, save smarter, and make better financial decisions.

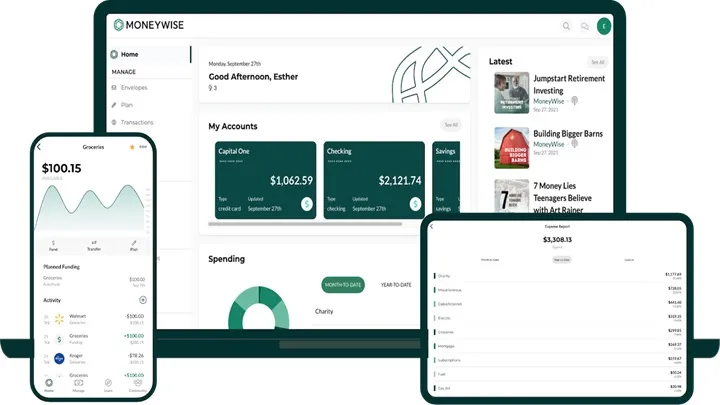

1. MoneyWise AI – Smart Finance Manager

Category: Personal Finance

MoneyWise AI helps control spending:

AI expense tracking

Smart budgeting plans

Spending habit analysis

Bill reminders

Financial goal setting

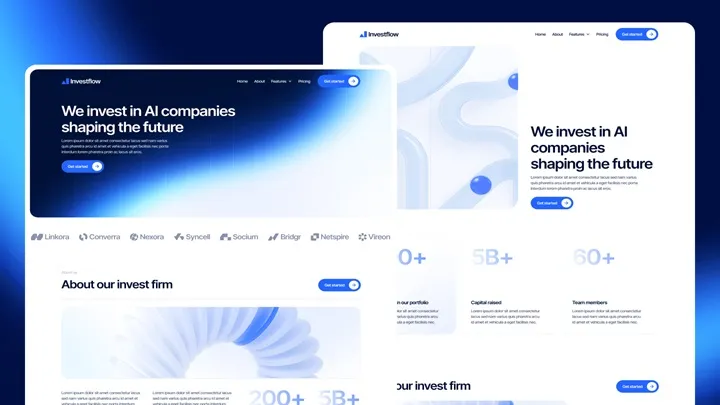

2. InvestFlow – AI Investment Assistant

Category: Investing

InvestFlow supports investing decisions:

AI-driven market insights

Portfolio performance tracking

Risk level analysis

Real-time price alerts

Beginner-friendly interface

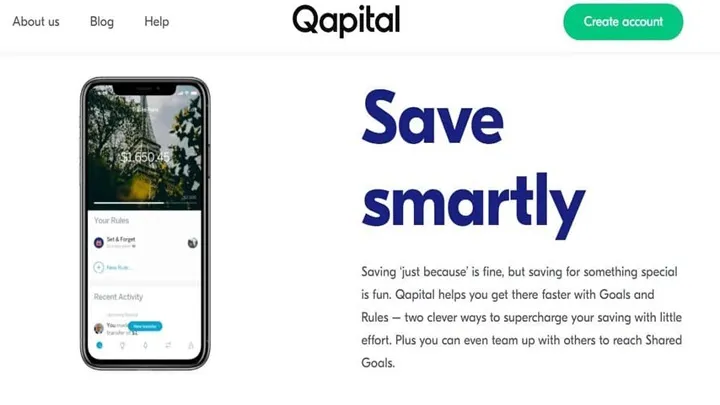

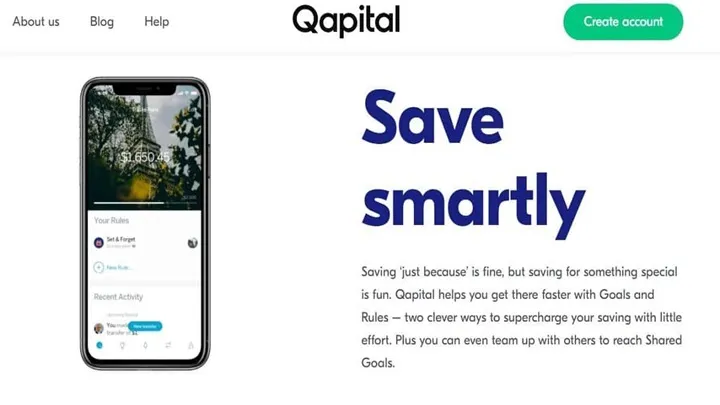

3. SaveSmart – Automated Savings App

Category: Savings

SaveSmart builds savings effortlessly:

AI-based saving rules

Automatic micro-savings

Custom saving goals

Spending balance insights

Secure cloud sync

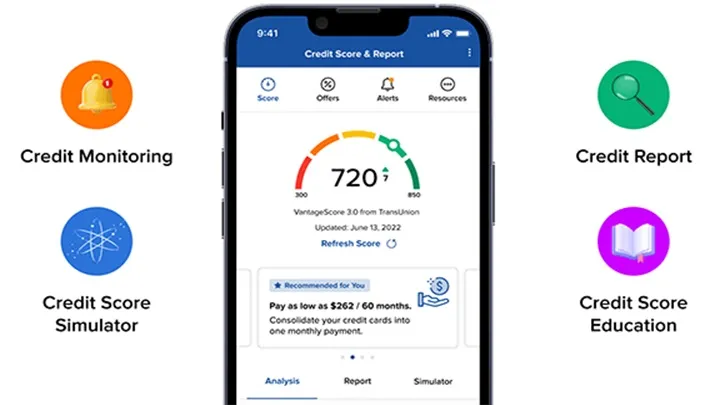

4. CreditGuard – Credit Score Monitor

Category: Credit Management

CreditGuard protects financial health:

Real-time credit score tracking

Fraud detection alerts

Credit improvement tips

Identity monitoring

Monthly credit reports

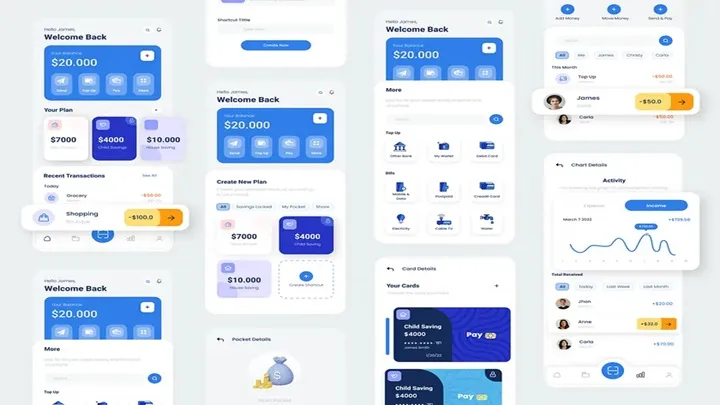

5. PayEase – Smart Payment Wallet

Category: Digital Payments

PayEase simplifies daily payments:

Fast digital transactions

Multi-currency support

Secure payment encryption

Expense history tracking

Subscription management

Conclusion

The Top 5 Finance Apps of 2025 — MoneyWise AI, InvestFlow, SaveSmart, CreditGuard, and PayEase — empower users to manage, grow, and protect their finances with smarter AI-driven tools.